Establishing A Real Estate Structure In Luxembourg – Nomilux

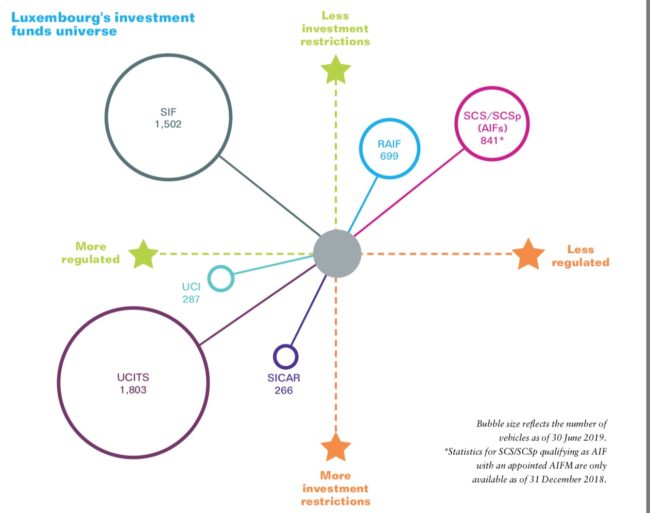

Establishing a real estate fund or company? There are different real estate fund types and companies in Luxembourg. Depending on the needs of investors and promoters, you can choose the most suitable fund type: SOPARFI: (Financial holding company or sociéte de participations financières). Due to its flexible financing policy, its structural benefits, its lack…